Introduction to NCLH stock

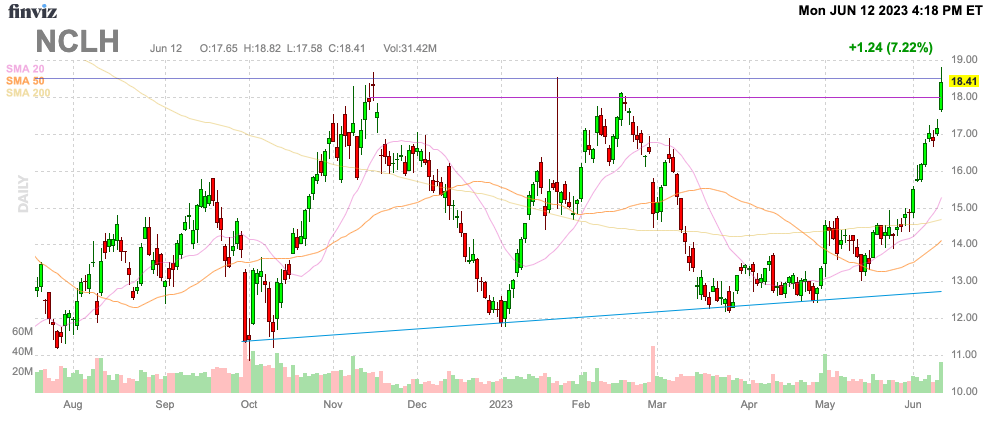

NCLH Stock Forecast 2025 has been a hot topic for investors, especially those with an eye on the cruise industry. As travel restrictions ease and demand for vacations surges, many highlight Norwegian Cruise Line Holdings Ltd. But what does the future hold for NCLH stock? With 2025 approaching, understanding market trends and consumer behavior is essential. In this blog post, we’ll dive into the current state of NCLH stock and explore critical factors that could shape its trajectory in the coming years. Whether you’re a seasoned investor or new, let’s uncover what you can expect from NCLH as we head toward 2025.

The current state of the cruise industry

The cruise industry has been navigating turbulent waters in recent years. Following the global pandemic, many cruise lines faced unprecedented challenges. Most ships were docked for extended periods, leading to significant financial losses.

As restrictions eased, a gradual recovery began. Bookings surged as travelers sought safe and enjoyable vacations at sea. However, the industry’s rebound is not uniform across all companies.

Consumer preferences have shifted toward more luxurious experiences and sustainable practices. Passengers are now more environmentally conscious than ever before.

Additionally, supply chain issues have affected inventory and staffing levels. Many ports also faced delays due to heightened regulatory measures.

Despite these hurdles, optimism remains within the sector. Innovations in technology and service delivery promise to enhance future voyages while attracting new passengers eager for adventure on the high seas.

Factors influencing the future of NCLH stock

Several factors will shape the future of the NCLH Stock Forecast 2025. The cruise industry’s recovery trajectory post-pandemic is crucial. As travel restrictions ease, passenger demand is expected to rise significantly.

Economic conditions play a vital role as well. Changes in consumer spending power can influence vacation choices, especially for cruises, which are often seen as discretionary expenses.

Fuel prices and operational costs also directly affect profitability. Any increase could squeeze margins if not managed wisely.

Regulatory changes may impact operations, too. Stricter health and safety regulations could lead to increased costs but might build consumer confidence over time.

Competition within the cruise sector remains fierce. Innovations in customer experience or sustainability initiatives by rivals can sway market share and investor sentiment toward NCLH’s prospects.

Expert opinions and predictions for NCLH Stock Forecast 2025

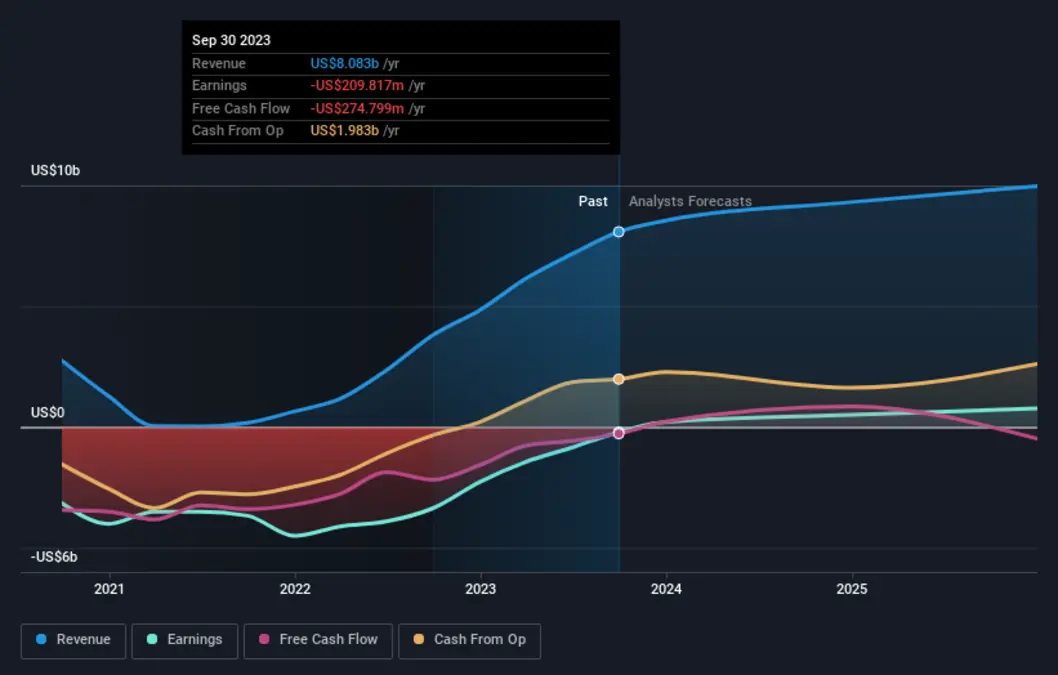

Analysts have mixed views on the outlook for NCLH Stock Forecast 2025. A resurgence in travel demand will significantly boost revenues, and they anticipate increased consumer confidence as more people return to cruising post-pandemic.

Others, however, caution against overoptimism. They point out potential headwinds, such as rising fuel costs and ongoing geopolitical tensions, that could impact global travel patterns.

Market experts are also watching the company’s strategic initiatives closely. Investments in sustainability and new ship launches may be vital in attracting environmentally-conscious travelers.

Many predict that if NCLH Stock Forecast 2025 can effectively navigate these challenges while capitalizing on growth opportunities, it could see a strong rebound by 2025. This sentiment also reflects cautious optimism about the cruise industry’s recovery trajectory.

Potential risks and challenges for NCLH in the coming years

NCLH Stock Forecast 2025 faces several risks as it navigates the post-pandemic landscape. One significant challenge is fluctuating consumer confidence in travel. Economic uncertainties can lead to reduced discretionary spending on vacations.

Health and safety regulations continue to evolve, impacting operational costs. Stricter guidelines might be necessary, leading to increased expenses for compliance and sanitation measures.

Additionally, competition within the cruise industry remains fierce. Rival companies constantly innovate their services, which may draw potential customers away from NCLH Stock Forecast 2025.

Environmental concerns also loom large. Increasing scrutiny over carbon emissions and waste management could result in higher operational costs or regulatory penalties.

Geopolitical issues can disrupt travel plans. Political instability in popular tourist destinations may deter travelers from booking cruises with NCLH altogether.

Steps investors can take to mitigate risk and maximize potential gains.

Investors looking to navigate the waters of NCLH Stock Forecast 2025 stock should prioritize diversification. By spreading investments across various sectors, they can buffer against industry-specific downturns.

Monitoring market trends is also crucial. Staying informed about economic shifts and consumer preferences can help investors anticipate changes that might impact cruise line operations.

Another viable strategy involves setting clear financial goals. Establishing targets for gains and losses allows investors to make decisions based on logic rather than emotion during volatile periods.

Utilizing stop-loss orders can further enhance risk management. This technique automatically sells shares once they reach a predetermined price, protecting against significant losses.

Conducting thorough research into company performance and industry developments will empower investors with knowledge. With insights, they are better equipped to identify timely market entry points or exit strategies.

Conclusion: Is NCLH an excellent long-term investment?

Several factors, including the current state of the cruise industry and broader economic trends, influence the outlook for NCLH Stock Forecast 2025. Investors must remain vigilant as companies like Norwegian Cruise Line Holdings (NCLH) navigate a post-pandemic recovery. The industry’s rebound appears promising but comes with challenges.

Expert opinions suggest cautious optimism about NCLH Stock Forecast 2025 growth trajectory. Analysts anticipate steady revenue increases as travel demand rises. However, potential risks like fluctuating fuel prices and changing consumer preferences could impact profitability.

Investors looking at NCLH Stock Forecast 2025 should consider diversifying their portfolios to mitigate risks associated with market volatility. Keeping abreast of macroeconomic indicators and company performance will also be vital.

As you weigh your investment options, you must assess the opportunities and challenges ahead for NCLH. The emerging landscape may present lucrative prospects alongside inherent risks that cannot be ignored. Understanding these dynamics can help shape informed decisions about whether this stock aligns with your long-term investment strategy.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?