Investing in stocks can be thrilling and daunting, especially when picking the right shares for your portfolio. Among the myriad choices on the Swedish stock market, the Volvo B Aktie is a solid option for those looking to invest in a well-established company with a rich history. In this article, we’ll delve into everything you need to know about Volvo B Aktie, from its historical performance to its current standing in the market. So, buckle up and get ready for a smooth ride through the world of Volvo stocks!

Understanding Volvo B Aktie

Volvo B Aktie refers to the class B shares of AB Volvo, a Swedish multinational company renowned for manufacturing trucks, buses, construction equipment, and marine and industrial engines. But before we explore the specifics of the B shares, it’s essential to understand what differentiates them from the A shares.

What Are Volvo B Shares?

In simple terms, Volvo B shares are one of the two types of shares that AB Volvo offers. The other type, Volvo A shares, is more expensive and has more voting rights. B shares, on the other hand, are typically more accessible to individual investors due to their lower price and offer fewer voting rights. Despite this, B shares are highly popular among investors more interested in the company’s financial performance rather than having a say in corporate decisions.

Why Invest in Volvo B Aktie?

Investing in Volvo B Aktie can be a wise decision for several reasons. First, Volvo is a globally recognized brand with a strong reputation for quality and innovation. This gives the company a competitive edge in the global market. Additionally, Volvo has a long history of stable financial performance, which makes it an attractive option for risk-averse investors. The B shares offer a more affordable entry point for those looking to invest in this automotive giant without breaking the bank.

Historical Performance of Volvo B Aktie

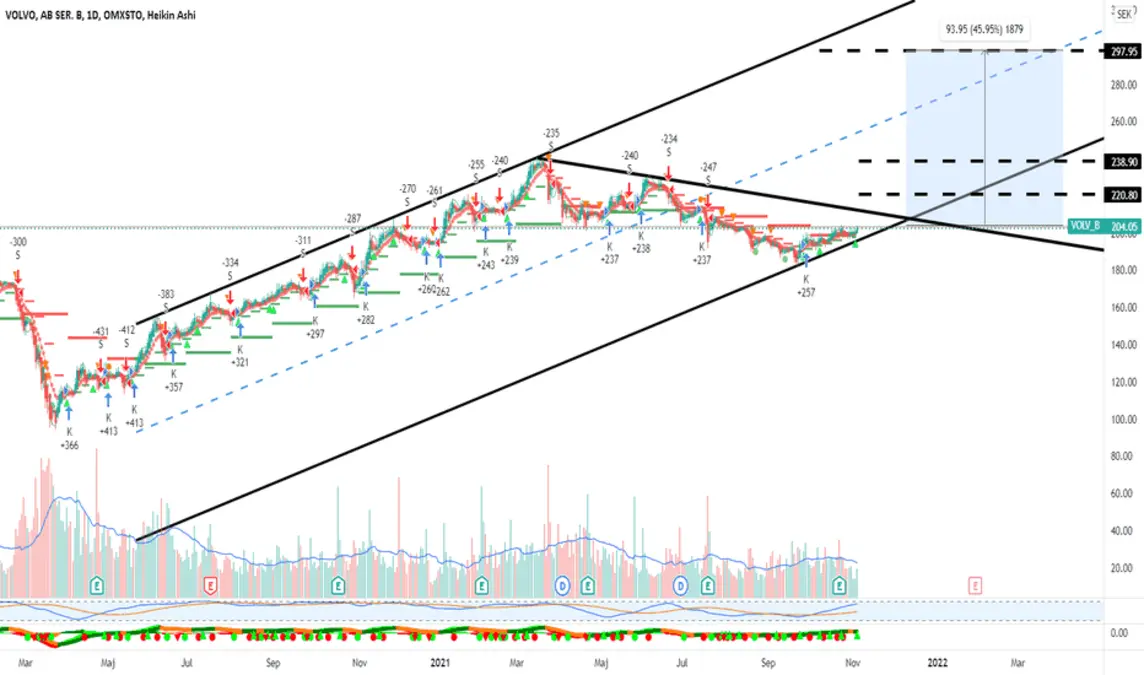

Historical performance is often a good indicator of a stock’s potential when investing. Volvo B Aktie has seen a variety of highs and lows over the years, reflecting the broader economic trends and specific challenges faced by the automotive industry.

Early Years and Growth

Volvo was founded in 1927 and has been traded on the Stockholm Stock Exchange since it went public. Over the decades, Volvo has grown from a small Swedish car manufacturer to a global leader in the automotive industry. Like the company, the B shares have steadily grown, particularly during economic expansion.

Navigating Economic Downturns

No company is immune to economic downturns, and Volvo is no exception. The global financial crisis 2008 and the Subsequent European debt crisis impacted Volvo’s share prices, including the B shares. However, the company’s strong management and ability to adapt to changing market conditions helped it recover and continue growing in the subsequent years.

Recent Performance

Volvo B Aktie has performed relatively well in recent years, benefiting from the company’s strategic focus on innovation and sustainability. Volvo’s commitment to electric vehicles and autonomous driving technology has positioned it as a forward-thinking player in the automotive industry. As a result, investors have shown confidence in the B shares, leading to a steady increase in their value.

Key Factors Influencing Volvo B Aktie

Several factors influence Volvo B Aktie’s performance, and understanding these can help investors make informed decisions. Let’s explore some of the most critical aspects that can impact the value of Volvo’sVolvo’s B shares.

Market Demand for Commercial Vehicles

Volvo is one of the world’s leading commercial vehicle manufacturers, including trucks and buses. As such, the demand for these vehicles directly affects the company’s revenue and, by extension, the value of its shares. Factors such as economic growth, infrastructure development, and regulation changes can all influence the demand for commercial vehicles.

Technological Innovation

The automotive industry is undergoing a significant transformation driven by technological advancements. Volvo has been at the forefront of this change, investing heavily in electric vehicles, autonomous driving, and connected services. These innovations help Volvo maintain its competitive edge and make the B shares more attractive to investors looking for long-term growth opportunities.

Global Economic Conditions

Like all stocks, Volvo B Aktie is influenced by global economic conditions. Economic downturns, changes in interest rates, and fluctuations in currency exchange rates can all impact the company’s financial performance and, consequently, the value of its shares. For instance, a slowdown in the global economy could lead to reduced demand for commercial vehicles, affecting Volvo’sVolvo’s revenue and share price.

How to Invest in Volvo B Aktie

Investing in Volvo B Aktie is relatively straightforward, especially if you’re a family who knows the basics. However, you should follow a few steps to ensure you’re making a well-informed investment decision.

Choose a Reputable Broker

The first step in investing in Volvo B Aktie is to choose a reputable broker that offers access to the Stockholm Stock Exchange, where Volvo shares are traded. Look for a broker that provides a user-friendly platform, reasonable fees, and access to research and analysis tools.

Analyze the Market

Before purchasing Volvo B Aktie, it’s essential to conduct thorough market research. This involves analyzing the company’s financial statements, understanding the broader market trends, and keeping an eye on any news or developments that could impact the stock price. Many brokers offer research tools and reports to help you make an informed decision.

Determine Your Investment Strategy

Once you’ve researched, it’s time to determine your investment strategy. Are you looking for short-term gains, or are you in it for the long haul? Your plan will dictate how you approach your investment in Volvo B Aktie. For example, if you’re a long-term investor, you might focus on the company’s potential for growth over the next few years rather than short-term market fluctuations.

Risks Associated with Investing in Volvo B Aktie

While Volvo B Aktie presents a promising investment opportunity, it’s important to know the risks. All investments carry some risk, and Volvo’s B shares are no exception.

Market Volatility

Market volatility is one of the primary risks associated with investing in stocks, including Volvo B Aktie. Stock prices can fluctuate due to various factors, including changes in the economy, shifts in consumer demand, and unexpected events. It’s essential to be prepared for these fluctuations and have a strategy to manage your investments during volatile periods.

Industry-Specific Risks

The automotive industry faces unique challenges that can impact the performance of companies like Volvo. These include regulation changes, supply chain disruptions, and shifts in consumer preferences. For example, a sudden increase in fuel prices or stricter emissions regulations could reduce the demand for traditional vehicles, affecting Volvo’sVolvo’s revenue and share price.

Global Economic Uncertainty

Finally, global economic uncertainty is a significant risk factor for Volvo B Aktie. As a multinational company, Volvo is exposed to various economic risks, including currency fluctuations, changes in trade policies, and geopolitical tensions. These factors can all impact the company’scompany’s financial performance and, consequently, the value of its shares.

Conclusion: Is Volvo B Aktie a Good Investment?

Investing in Volvo B Aktie can be an excellent option for those looking to add a stable, well-established company to their portfolio. Volvo’s strong brand, commitment to innovation, and solid financial performance make it a promising investment, particularly for those interested in the long-term potential of the automotive industry.

However, like all investments, it’s essential to approach Volvo B Aktie with a clear strategy and an understanding of the potential risks. By researching, staying informed about market trends, and working with a reputable broker, you can make an informed decision and potentially reap the rewards of investing in one of Sweden’s most iconic companies.

In the end, whether you’reyou’re a seasoned investor or just starting, Volvo B Aktie offers a unique opportunity to invest in a company with a rich history and a bright future. So, why take the plunge and see where the road takes you?

Your article helped me a lot, is there any more related content? Thanks!

Your article helped me a lot, is there any more related content? Thanks!

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Your article helped me a lot, is there any more related content? Thanks!